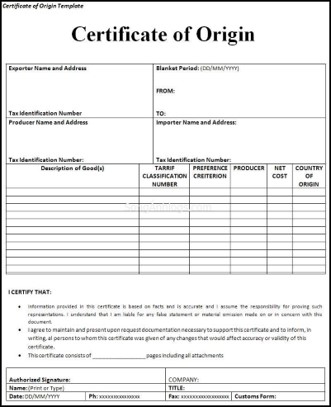

CERTIFICATE OF ORIGIN C/O

1.CERTIFICATE OF ORIGIN (C/O)

C/O is a common document in import and export of goods, and is an important document to determine the origin of goods from which import and export enterprises can enjoy preferential tax policies if the goods are in the list of preferential goods according to the trade agreement between the two importing and exporting countries. So what are the characteristics of CO, and how to get CO?

1.2 What is C/O?

C/O (Certificate of Origin) is an important document in import and export. C/O indicates the origin of goods produced in which territory or country.

The English term is Certificate of Origin, often abbreviated as C/O.

By mid-2022, Vietnam has participated in 17 Free Trade Agreements (FTAs). Correspondingly, there are all forms of certificates of origin, to enjoy special preferential tax rates.

In addition, there are regular C/O forms, confirming the origin of goods without granting special tax incentives. Therefore, you will see that there are quite a few types of C/O, depending on each specific shipment (what type of goods, which country to/from…) you will determine which form you need.

1.3 Forms of C/O

Currently, there are the following popular types:

- C/O form A (Preferential C/O form used for Vietnam’s export goods)

- CO form B (Non-preferential C/O form used for Vietnam’s export goods)

- C/O form D (ASEAN countries)

- C/O form E (ASEAN – China).

- C/O form EAV (Vietnam – Eurasian Economic Union)

- C/O form AK (ASEAN – Korea), form KV (Vietnam – Korea)

- C/O form AJ (ASEAN – Japan)

- C/O form VJ (Vietnam – Japan)

- C/O form AI (ASEAN – India)

- C/O form AANZ (ASEAN – Australia – New Zealand)

- C/O form VC (Vietnam – Chile)

- C/O form S (Vietnam – Laos; Vietnam – Cambodia)

2. PURPOSE OF ISSUING C/O

2.1 Purpose of Certificate of Origin (C/O)1:

- To establish measures and serve as an instrument of trade policy;

- To determine whether imported products are entitled to most-favored nation (MFN) status or other preferences;

- For the purpose of a country’s trade statistics;

- To apply regulations on labeling and labeling requirements for goods; and

- For government purchases

2.2 Role of Rules of Origin (ROO)2:

The basic role of Rules of Origin is to determine the country of origin of a particular item. Legal or administrative requirements that must be complied with when goods are traded on the international market. This is necessary for the implementation of various trade policy instruments such as the imposition of import duties, quota allocation or trade statistics.

The first steps are to classify the goods and determine the value of the goods, the next and final step is to determine the country of origin of a particular product. Classification of goods and determination of value are very important in customs procedures, but these are basic tools to determine the country of origin of goods in the sense that the rules of origin are rules that apply specifically to a certain product related to specific HS codes, and if the rules of origin apply according to added value, it is necessary to determine the customs value of the components that make up the product.

2.3 Competent authority to issue C/O of Vietnam:

The Ministry of Industry and Trade is the agency that organizes the issuance of Certificates of Origin of exported goods; directly issues or authorizes the Vietnam Chamber of Commerce and Industry (VCCI) and other organizations to issue Certificates of Origin of goods.

Currently, the Ministry of Industry and Trade has the right to issue C/O. This Ministry authorizes a number of agencies and organizations to undertake this task. Each agency is granted certain types of C/O, specifically as follows:

- Vietnam Federation of Commerce and Industry (VCCI): grants C/O forms A, B, TR, X…

- Import-Export Management Departments of the Ministry of Industry and Trade: grants C/O forms D, E, AK, AJ…

- Export Processing Zone-Industrial Zone Management Boards authorized by the Ministry of Industry and Trade: grants C/O forms D, E, AK…

3. NOTES WHEN MAKING C/O AND PROCEDURES FOR APPLYING FOR C/O

3.1 Notes for Enterprises applying for C/O for the first time

a) For units applying for C/O for the first time

For units applying for C/O for the first time, it is necessary to prepare and submit additional C/O unit dossiers (Traders, Organizations, Individuals; List of production establishments; Registered contact representatives, signatures on C/O dossier documents and stamps, signatures). Changes during the operation must be promptly notified to be added to the dossier. Before preparing the C/O documents, the Business Profile must be filled out in 3 pages (download the form here). Enterprises must register online through the websites www.covcci.com.vn and www.ecosys.gov.vn

After submitting the above documents to VCCI, enterprises must prepare a complete set of C/O application documents as follows:

- Application for C/O (1 copy, according to the form)

- Completed C/O forms: at least 4 copies (1 original and 1 copy for the C/O unit to send to the customer, 1 copy for the C/O unit to keep, 1 copy for the C/O issuing agency to keep. For the ICO form, an additional First copy must be made for VCCI to send to the International Coffee Organization ICO).

- Export documents (proving goods exported from Vietnam)

+ Export license (if any)

+ Export customs declaration

+ Export certificate (if any)

+ Invoice (or invoice with VISA for textile and garment products exported to the US under quota management)

+ Bill of lading

4. Documents explaining and proving the Vietnamese origin of the goods:

+ Sales and purchase documents, export authorization, etc. of finished products.

+ Customs norms (if any)

+ List of raw materials used (according to the form)

+ Import documents, or purchase of raw materials

+ Summary production process (in case the regulations on origin have related regulations, or when other documents do not clearly show the origin of the goods).

+ Inspection (or appraisal) certificate of the competent specialized agency (in case the regulations on origin have related regulations, or when other documents do not clearly show the origin of the goods).

b) In addition, if necessary to clarify the origin of goods, VCCI may request to present additional documents such as an official dispatch explaining a specific issue, a contract, L/C, etc., or samples, models of products, raw materials used, or conduct an actual inspection of product production, etc.

c) Documents issued by other agencies (bill of lading, customs declaration, export license, etc.) the unit must submit a photocopy, and present the original for comparison.

d) The unit must keep a complete C/O file (at least the set submitted to VCCI) for a minimum of 5 years, and must keep a copy of the red-stamped C/O issued by VCCI (the photocopy is for reference only, not for comparison).

Note: it is necessary to declare accurately on all documents related to the issuance of C/O. The content of the documents must be authentic, valid and consistent.

3.2 VCCI’s C/O application process:

C/O application process of Enterprises (Enterprises have registered their business profile with the C/O issuing organization) on the COMIS system

Step 1. Declare the application for a certificate of origin.

- Enterprises declare the application on the Comis system including:

- Declare the application on the system

- Scan the attached files including:

- Commercial invoice;

- Export customs declaration;

- Rate of use of raw materials;

- Detailed calculation table of regional value content or detailed declaration of HS codes of input materials and HS codes of output products.

- Sales invoice and import customs declaration of input materials.

Format: .doc, .xlsx, .jpeg, .png, .rar, …

Maximum capacity: no more than 10mb

Step 2. Automatically issue C/O number. The VCCI system will automatically issue C/O number when the enterprise completes the declaration on the Comis system.

- Step 2.1:Receive C/O number. The enterprise system receives C/O number.

- Step 2.2: Edit C/O file. Enterprises can edit the file when there is no confirmation from VCCI specialist to process the file.

Step 3. Send C/O file. Enterprises send C/O file after completing it.

Step 4. Receive C/O file. VCCI system receives file sent from enterprise system.

Step 5. Review C/O file

- VCCI specialist reviews the file:

- If the file is incomplete: go to step 6.

- If the file is complete: go to step 7.

Step 6. Reject C/O file. VCCI specialist rejects the file. Required input: Reason for rejection.

- Step 6.1 Receive C/O file rejection notice. Enterprises receive Rejection notice from VCCI system and supplement and edit information according to step 6.2.

- Step 6.2 Supplement and edit C/O information. The enterprise supplements and edits the information as required and then resubmits the application. The process returns to step 3.

Step 7. Approval of C/O issuance. When the application is complete, the specialist will review and approve the issuance of C/O to the enterprise.

Receive notification of the application being approved for C/O issuance. The enterprise receives notification of the application being approved for C/O issuance

Step 8. Sign and stamp the C/O form. VCCI signs, stamps the C/O form and returns it to the enterprise

4. ADDITIONAL REFERENCES:

- System of legal documents related to Certificate of Origin, in which it is necessary to pay attention to Decree 31/2018/ND-CP, Circular 05/2018/TT-BCT

- Notes and related information about VCCI Certificate of Origin:

HML SUPPLY CHAIN,. JSC

Tel: +84 82 369 2828

Email: infor@hml.com.vn

Website: hml.com.vn