PROCEDURES FOR IMPORTING GAS MASKS

1. Gas mask import policy

Compared to normal goods, gas masks are goods with many regulations when importing that you need to pay attention to. Because this item is under the specialized management of the Ministries when importing. Therefore, import regulations are often complicated and there are many notes that importers must pay attention to when carrying out customs procedures. Specifically:

- According to current regulations, 100% new gas masks are not on the list of goods prohibited from being imported into Vietnam, so businesses are allowed to import them into the country.

- Gas masks are under the specialized management of the Ministry of Labor, War Invalids and Social Affairs, so when importing, you must carry out the product’s conformity procedures.

Thus, it can be seen that in addition to the normal import procedures, when importing gas masks, you must carry out the product’s conformity procedures. Therefore, to ensure that goods clear customs smoothly and are eligible for sale on the market, you must carry out the import procedures correctly and completely.

2. HS Code and Import Tax of Gas Masks

2.1 HS Code of Gas Masks

When importing goods, the HS code is important information that you need to determine for the imported item. Because the HS code is a commodity classification code used as a basis to learn about some import regulations and policies related to tariffs.

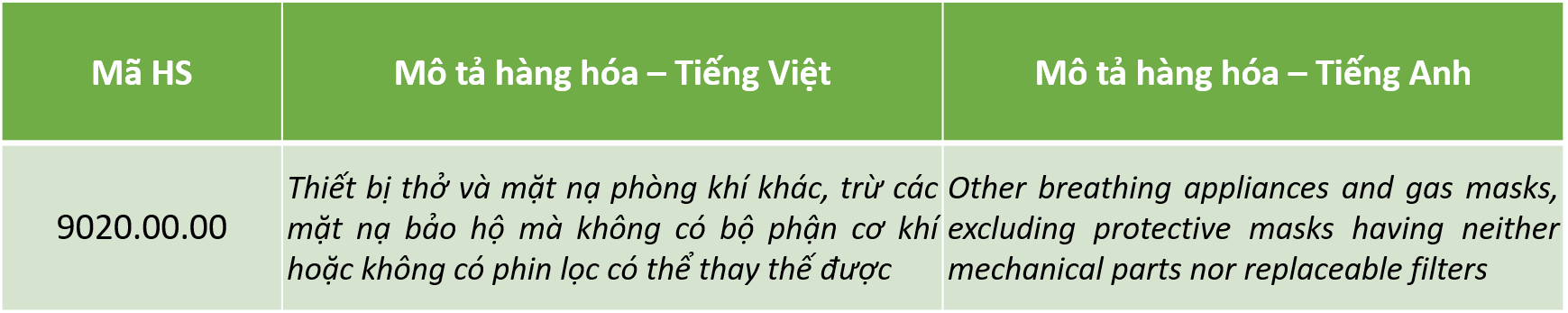

For gas masks, the product has an HS code under Chapter 90 – Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; parts and accessories thereof.

- 9020.00.00: Other breathing appliances and gas masks, excluding protective masks having neither mechanical parts nor replaceable filters.

Để chắc chắn mặt hàng nhập về xác định đúng mã HS, bạn cần căn cứ vào đặc điểm, tính chất, thành phần, tài liệu kỹ thuật,… của hàng hóa thực tế nhập khẩu để tiến hành tra cứu cho chính xác.

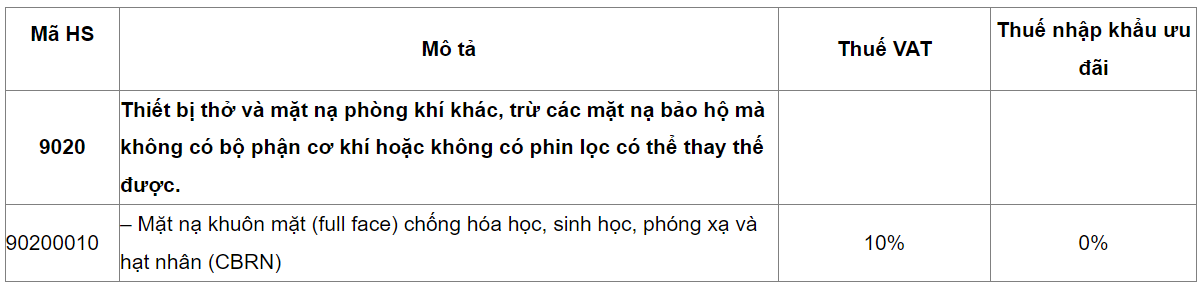

2.2 Import tax on gas masks

When importing gas masks, importers must pay the following taxes:

- Value added tax – also known as VAT

- Import tax

3. Procedures for importing gas masks

3.1 Required documents when importing gas masks

Customs documents for importing gas masks usually include electronically submitted scans or originals of the following documents:

- Import customs declaration

- Commercial Invoice – Copy of the enterprise, with some branches, the original must be submitted when the shipment applies special preferential tax with some C/O forms (eg: Form E)

- Bill of lading – Copy of the enterprise

- Packing List

- Commercial contract

- Certificate of origin – Original or electronic copy in case the importer wants to enjoy special preferential import tax

- Certificate of conformity

- With some branches: add the Agreement on Developing Customs – Enterprise Partnership – Original

- Other documents (if any)

3.2 Procedures for registering for quality inspection of imported gas masks

For imported gas masks, a declaration of conformity must be made according to regulations. Specifically, the product must be certified according to method 7 stated in Article 5 of Circular No. 28/2012/TT-BKHCN. The certificate of conformity according to method 7 is only valid for the shipment being assessed and certified. The procedure is as follows:

- Step 1: Register for a paper certificate of conformity according to the form

- Step 2: The importing enterprise registers for quality inspection procedures with Customs (for imported shipments)

- Step 3: Conduct assessment and take samples of the shipment (can be taken at the port or at the warehouse)

3.3 Labels for imported gas masks

Imported goods must have full labels according to current regulations.

In particular, the product label must show the following contents:

a) Product name;

b) Name and address of the organization or individual responsible for the product;

c) Product origin.

3.4 Procedures for importing gas masks

Step 1: Declare and transmit the declaration

After the shipping company sends the notice of arrival of the goods, the enterprise needs to proceed with the customs declaration and fill in all the information on the declaration. When the declaration is completed and transmitted, the system will automatically issue a number if the information is correct and complete.

Step 2: Get the delivery order

Enterprises need to prepare the following documents and bring them to the shipping company to get the delivery order:

– Copy of ID card/Citizen ID card.

– Copy of bill of lading.

– Original bill of lading with stamp.

Step 3: Register for specialized inspection for the import customs procedure dossier

Depending on the imported product, it is necessary to register for specialized inspection (plant quarantine, animal quarantine, food quality inspection, declaration paper, import license, etc.)

For products that are gas masks, a certificate of conformity is required.

Step 4: Clear the customs declaration

After the declaration is transmitted, the system will classify the goods based on the content of the declaration. Specifically, it can be a green channel, yellow channel or red channel. Depending on the type, the enterprise needs to carry out different procedures.

- Green channel: the enterprise does not need to check or do any additional procedures. Enterprises only need to print the declaration and pay taxes.

- Yellow channel: Customs units are required to check the paper documents of the shipment.

- Red channel: Goods are inspected. The inspection process will be extremely strict and rigorous, taking more time and causing many additional costs.

Step 5: Clearing goods

After having the quality inspection results, add them to the dossier for customs clearance of goods.

3.5 Notes when importing gas masks

- Price risk management:

This is a customs service used to avoid fraud when declaring the price of goods. Gas masks are included in the price risk management list. When customs suspects that the declared value of goods on the customs declaration is lower than the actual value, they will invite the business to consult the price with customs.

- Goods label

This is mandatory information when you import goods. It is best to ask the seller to take a picture of the label so that you can check it with your records in advance and use the information on the label to make an accurate customs declaration.

The label of gas masks must have the following information:

– Name of goods

– Origin of goods

– Name and address of the organization or individual responsible for the goods

– Model, product code, instructions for use, components (this is optional information, if any, please pay attention to clearly declare it on the declaration form).

4. Why choose HML as the logistics unit to import gas masks?

With many years of experience, HML is confident in providing customers with the best service quality, the most competitive prices and the most professional staff.

- HML is a member of domestic and international logistics associations such as VLA, WCA, JCTRANS, PPL, …

- Committed to providing customers with the best service experience, prioritizing customer benefits.

- Fast, complete and free service consultation. Answer customer questions anytime, anywhere.

- For customers who are new to the import-export field, we are committed to providing free consultation on import-export procedures and processes in a complete, accurate and fast manner.

- Keep customer information confidential.

- Simple, fast and professional procedures.

- A team of well-trained staff, always working with a high sense of responsibility with the motto ANYTIME – ANYWHERE.

HML SUPPLY CHAIN,. JSC

Tel: +84 82 369 2828

Email: infor@hml.com.vn

Website: hml.com.vn