Procedures for Exporting Frozen Seafood

The fisheries industry is currently one of the key economic sectors, playing an important role in the development of the Vietnamese economy with an increasingly expanding scale. This is also an opportunity for the development of exporting aquatic products to the world. In order to access the international market in a deep and long-term way, shippers and businesses need to grasp the process and procedures when exporting aquatic products, contributing to promoting the trade process between Vietnam and countries around the world.

1. Policy on frozen seafood export

Pursuant to the provisions of Clause 2, Article 31 of Circular No. 04/2015/TT-BTC dated February 12, 2015 of the Ministry of Agriculture and Rural Development on export without permission:

- For aquatic species not listed in the list of aquatic species prohibited from export as clearly specified in Appendix 1 issued with this Circular, when exporting, traders shall carry out customs procedures. For aquatic species under CITES management, customs procedures shall be carried out in accordance with the regulations of CITES Vietnam.

- For aquatic species listed in the list of aquatic species subject to conditional export as specified in Appendix 2 issued with this Circular, if meeting all the conditions stated in this Appendix, when exporting, the unit shall carry out customs procedures. For aquatic species under CITES management, procedures shall be carried out in accordance with the regulations of CITES Vietnam.

- Pursuant to the provisions of Clause 1, Article 4 of Circular No. 04/2015/TT-BTC dated February 12, 2015 of the Ministry of Agriculture and Rural Development: Goods listed in the list of aquatic products and aquatic products subject to quarantine. Therefore, exported frozen aquatic products must be quarantined before customs clearance according to the provisions of law.

2. HS codes for frozen seafood

Frozen seafood has HS codes under

- Group 03 – Fish and crustaceans, molluscs and aquatic invertebrates. Below are the HS codes of some types of frozen seafood: Group 0303 – Fish, frozen, excluding fish fillets and other fish meat of Group 03.04.

- Group 0304 – Fish fillets and other fish meat (whether or not minced), fresh, chilled or frozen.

- Group 0306 – Crustaceans, whether in shell or not, live, fresh, chilled or frozen,…

- Group 0307 – Molluscs, whether in shell or not, live, fresh, chilled or frozen,…

- Group 0308 – Aquatic invertebrates other than crustaceans and molluscs , live, fresh, chilled or frozen,…

3. Procedures for exporting frozen seafood

3.1 Customs dossier for exporting frozen seafood

The customs dossier for exporting frozen seafood includes the following documents and certificates:

- Customs declaration

- Input documents of goods (invoice, purchase list)

- Commercial invoice

- Sales contract (if any)

- Bill of Lading

- Packing list

- And some documents that may be required according to the requirements of the importing partner:

- Certificate of Origin (C/O)

- Other related documents,…

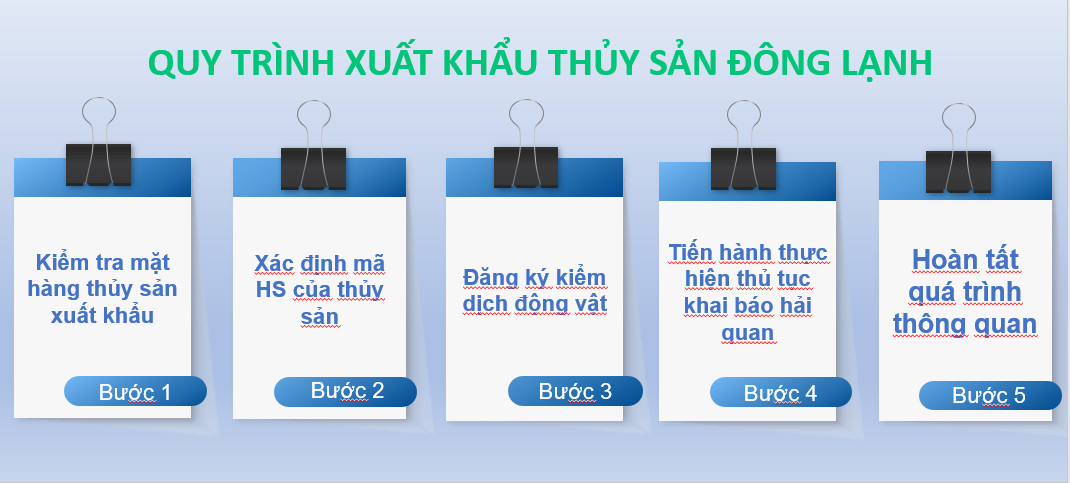

3.2 Frozen seafood export process

Step 1: Checking exported aquatic products

Before exporting, enterprises need to check whether their aquatic products are on the list of permitted exports or not based on Clause 2, Article 31 of Circular 04/2015/TT-BTC dated February 12, 2015 of the Ministry of Agriculture and Rural Development.

For aquatic products not listed in the list of aquatic products prohibited from export in Appendix 1 of the Circular, when exporting, enterprises must carry out customs procedures (for aquatic products managed by CITES, they will be carried out according to the regulations of CITES Vietnam).

For aquatic products listed in the list of aquatic products subject to conditional export in Appendix 2 of the Circular, if they meet the conditions, exporting enterprises will carry out customs procedures (for aquatic products managed by CITES, they will be carried out according to the regulations of CITES Vietnam).

Step 2: Determine the HS code of aquatic products

Next, enterprises need to determine the HS code of aquatic products. This helps classify goods and customs authorities rely on it to apply appropriate tax rates.

For example, the HS code of pangasius is 0302.89.19, basa fish 0302.72.90, rock lobster 0306.31.10, sea crab 0306.24.10, field frog 0106.90.00, freshwater yellow grouper 0301.11.99,…

To quickly look up the HS code, businesses can use the official website of Vietnam Customs to determine the exact HS code.

Step 3: Register for animal quarantine

When exporting frozen or fresh seafood, a Health Certificate (HC) is required. How to register for quarantine is as follows:

Prepare documents:

* Frozen seafood:

- Application for quarantine.

- Quarantine requirements of the importing country (if any).

- Sample of quarantine certificate from the competent authority of the importing country (if any).

*Fresh seafood:

- Application for quarantine.

- Permit of the competent authority for aquaculture with species listed in the list of aquatic products subject to conditional export or aquatic products prohibited from export.

- Permit of the CITES authority of Vietnam for aquatic products/aquatic products on the list of endangered and rare wild animals and plants according to the regulations of Vietnam or in the CITES Appendix.

- Requirements on quarantine criteria of the competent authority of the importing country (if any).

- Sample of quarantine certificate as required by the competent authority of the importing country (if any).

- Other documents such as regional certificate, disease-free facility certificate where aquaculture is carried out (if any), etc.

Agency submitting dossier: Enterprises submit dossiers to the Department of Animal Health. Officers will carefully inspect the goods by checking the quantity, type, taking product samples for testing, etc.

Receiving dossiers and returning results: Officers of the Department of Animal Health will check the validity of the dossier. If the dossier meets the requirements, the officer will notify the results and send an appointment to receive the quarantine certificate. If the dossier is missing, the enterprise needs to supplement the required documents.

Step 4: Carry out customs declaration procedures

After completing the documents, the owner of the goods needs to make an electronic customs declaration. Note that the customs declarant needs to fill in all the information of the exported goods when declaring, avoiding errors because it will affect the customs clearance process.

If there is no experience, the owner of the shipment needs to use an external customs clearance agent service to help the declaration process take place safely and quickly, while avoiding unnecessary risks.

Once the declaration is completed and the declaration has been transmitted, the system will automatically issue a number if the information is correct and complete. The importer needs to confirm the information to make sure there are no errors.

Pay taxes and necessary documents at the customs office as declared on the declaration. In addition, depending on the classification results, consider whether the shipment needs to be physically inspected or not. There are 3 streaming results, specifically:

- For green lane: exempted from detailed document inspection, exempted from actual goods inspection when the enterprise complies well with customs law regulations,

- For yellow lane: customs will exempt from actual goods inspection, but check detailed documents.

- For red lane: Customs checks detailed documents and conducts detailed goods inspection with different levels of actual inspection of the shipment.

Step 5: Complete customs clearance

When the documents are approved by customs, submit them to the shipping line to complete the customs clearance process. After completing the above steps, the unit has completed the customs clearance process for exporting aquatic products.

4. Regulations on procedures for exporting aquatic products

4.1 Regulations on procedures for exporting aquatic products

Exporting aquatic products must comply with the following procedural regulations:

Procedures for exporting fresh aquatic products

- Traditional export customs procedures

Prescribed in Article 12 of Circular No. 128/2013/TT-BTC dated September 10, 2013 of the Ministry of Finance stipulating customs procedures; customs inspection and supervision; export tax, import tax and tax management for exported goods.

Prescribed in Decision No. 1171/QD-TCHQ dated June 15, 2009 on promulgating customs procedures for commercial export goods.

- Electronic customs procedures

Prescribed in Circular No. 22/2014/TT-BTC dated February 14, 2014 of the Ministry of Finance.

Prescribed in Decision No. 988/QD-TCHQ dated March 28, 2014 on promulgating electronic customs procedures for commercial export goods.

Procedures for exporting frozen seafood

- Traditional export customs procedures

Prescribed in Circular No. 38/2015/TT-BTC dated March 25, 2015 of the Ministry of Finance stipulating customs procedures; customs inspection and supervision; export tax, import tax and tax management for exported goods.

Prescribed in Joint Circular No. 44/2013/TTLT-BCT-BKHCN dated December 31, 2013 of the Ministry of Industry and Trade and the Ministry of Science and Technology stipulating the management of domestic production quality.

Prescribed in Decision No. 1171/QD-TCHQ dated June 15, 2009 on promulgating customs procedures for commercial export goods.

- Electronic customs procedures

Prescribed in Circular No. 22/2014/TT-BTC dated February 14, 2014 of the Ministry of Finance.

Stipulated in Decision No. 988/QD-TCHQ dated March 28, 2014 on Promulgating electronic customs procedures for commercial export goods.

4.2 Notes when carrying out procedures for exporting and transporting frozen seafood

Certificate of Origin (C/O) when exporting seafood

This certificate is not a mandatory document in the customs clearance process for the shipment. However, the buyer can request the enterprise to make a certificate of origin for some markets that have signed a trade agreement between the importing country and Vietnam. Therefore, the importer can use the certificate of origin to get preferential import tax rates. For example, if exporting to the ASEAN market, it is form D (certificate of Origin Form D), the Chinese market uses form E, the US market uses form B, etc.

Documents required for applying for C/O when exporting ceramics include:

- Bill Of Lading, Invoice, Packing List, Customs Clearance Declaration

- Production norms, production process

- Input materials (import declaration, raw material purchase invoice, purchase list…)

What to note when transporting and preserving frozen and fresh seafood

To ensure that goods arrive safely and intact, businesses need to be careful in the packaging of seafood.

- Fresh seafood: Put fresh seafood in foam boxes, put dry ice at the bottom of the box to keep it fresh or use specialized cardboard boxes for seafood, which are waterproof to help preserve it in the best way.

- Frozen seafood: Seafood is wrapped in plastic bags or placed in foam boxes. The storage temperature is around -20 degrees Celsius is stable.

Enterprises need to accurately time the container unloading to avoid additional costs at the port.

Ensure that the quality of goods before export is preserved intact with unchanged quality and achieve the most optimal profit.

Note the proportion of ice-glazed volume with frozen seafood/aquatic products (under 5%); cut/peeled crustaceans and frozen processed products (under 7%); frozen whole crustaceans/products from crustaceans (under 14%); other aquacultured seafood/aquatic products (under 8%).

5. HML is a professional seafood export procedure service provider

With many years of experience, HML is confident in providing customers with the best service quality, the most competitive prices and the most professional staff.

- HML is a member of domestic and international logistics associations such as VLA, WCA, JCTRANS, PPL, etc

- Committed to providing customers with the best service experience, prioritizing customer benefits.Fast, complete and free service consultation.

- Answer customer questions anytime, anywhere.

- For customers who are new to the import and export sector, we are committed to providing free consultation on import and export procedures and processes in a complete, accurate and fast manner.

- Confidential customer information.

- Simple, fast and professional procedures.

- Our staff is well-trained, always working with a high sense of responsibility with the motto ANYTIME – ANYWHERE.

HML SUPPLY CHAIN,. JSC

Tel: +84 82 369 2828

Email: infor@hml.com.vn

Website: hml.com.vn