The Government of the Socialist Republic of Vietnam and the Government of the United Kingdom of Great Britain and Northern Ireland signed an Agreement on Cooperation and Mutual Administrative Assistance in the Field of Customs, within the framework of General Secretary Tô Lâm’s official visit to the United Kingdom.

Within the framework of General Secretary Tô Lâm’s official visit to the United Kingdom of Great Britain and Northern Ireland on October 29–30, 2025, Minister of Finance Nguyễn Văn Thắng, authorized by the Government of the Socialist Republic of Vietnam, signed the Agreement between the Government of the Socialist Republic of Vietnam and the Government of the United Kingdom of Great Britain and Northern Ireland on Cooperation and Mutual Administrative Assistance in the Field of Customs.

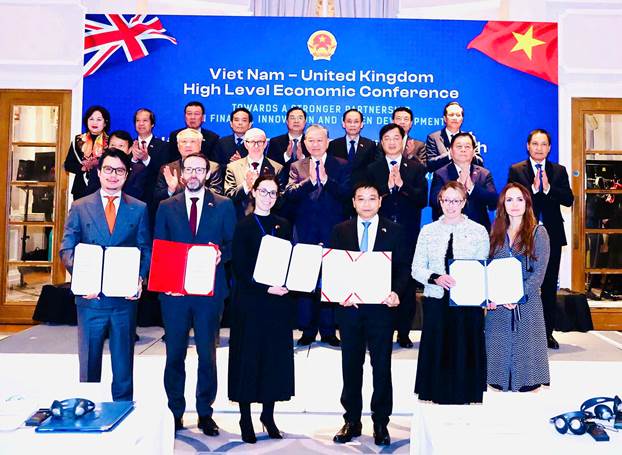

The Agreement was presented during the Official Document Exchange Ceremony, witnessed by senior leaders of both countries, on the morning of October 30, 2025 (local time) in the United Kingdom.

In the “Joint Statement on Upgrading Vietnam–UK Relations to a Comprehensive Strategic Partnership”, issued by General Secretary Tô Lâm and UK Prime Minister Keir Starmer on October 29, 2025, the signing of the Agreement on Customs Cooperation and Mutual Administrative Assistance was identified under Pillar II – Strengthening Cooperation in Economy, Trade, Investment, and Finance as one of six key cooperation pillars between Vietnam and the United Kingdom.

Prior to this Agreement, customs cooperation between Vietnam Customs and its UK counterparts had been conducted through a Cooperation Arrangement with His Majesty’s Revenue and Customs (HMRC) and several Memoranda of Understanding with the UK Border Force.

As these commitments were non-binding in nature, cooperation activities primarily focused on information exchange regarding each country’s legal frameworks, as well as technical assistance programs to strengthen the capacity of Vietnamese customs officers in control operations and support through equipment donations for inspection and supervision work.

The signing of a government-level cooperation agreement marks a significant milestone, establishing a robust legal framework for mutual assistance and cooperation in customs.

It expands the scope and depth of collaboration in areas such as customs control, anti-smuggling investigations, and trade fraud prevention, thereby ensuring sustainable trade flows between the two countries.

Furthermore, the Agreement reinforces commitments to trade facilitation under the Vietnam–UK Free Trade Agreements, through close coordination between the customs authorities of both sides.

The inclusion of Authorized Economic Operator (AEO) program cooperation also creates new opportunities to further streamline export and import activities for trusted enterprises, ensuring faster and more secure legitimate trade flows between Vietnam and the United Kingdom.

Earlier, on the sidelines of the Investment Promotion Conference chaired by Minister of Finance Nguyễn Văn Thắng in the United Kingdom from September 15–17, 2025, a delegation from the General Department of Vietnam Customs, led by Mr. Nguyễn Văn Thọ, Director General, held a bilateral meeting with Ms. Megan Shaw, authorized representative of HM Revenue and Customs (HMRC).

During the meeting, both sides emphasized the acceleration of internal procedures to enable the early signing of the Agreement, a point reaffirmed in the “Joint Statement of Intent on Cooperation between Vietnam Customs and HM Revenue and Customs.”

The Statement of Intent also outlined plans to enhance cooperative activities aligned with the realities of customs administration and the needs of both sides, with the shared goal of facilitating legitimate trade, promoting investment, and ensuring the security and safety of global supply chains.

.jpg)

In the coming time, through cooperation and mutual administrative assistance activities under the framework of the newly signed Agreement, both sides will work together more effectively in information exchange to support control, prevention, and combat of illegal trafficking of goods such as narcotics, tobacco, as well as crimes related to tax evasion, money laundering, and environmental violations—especially in the context of increasingly sophisticated and complex smuggling and trade fraud schemes.

At the same time, the two sides will promote the implementation of cooperative initiatives, experience sharing, and capacity building in professional areas of mutual interest, including digital transformation, technology application in customs management, Authorized Economic Operator (AEO) programs, risk management, time release studies, advance rulings, and tax fraud prevention.

Source: Vietnam Customs