The dominance of the ‘giants’ in maritime container transport

The growth of container shipping has been accompanied by a trend towards market concentration among a small number of super-large carriers.

Container shipping plays a key role in global trade, with 163 million TEUs transported in 2022. During the period 1980-2022, the average annual growth rate was 6.1%, compared to 2.8% for maritime transport in general. In terms of volume, container ships carry less than 25% of total seaborne cargo, but in terms of value (8,882 billion USD), it accounts for 66%. Goods transported by container ships account for 37.5% of the value of international trade.

Market structure

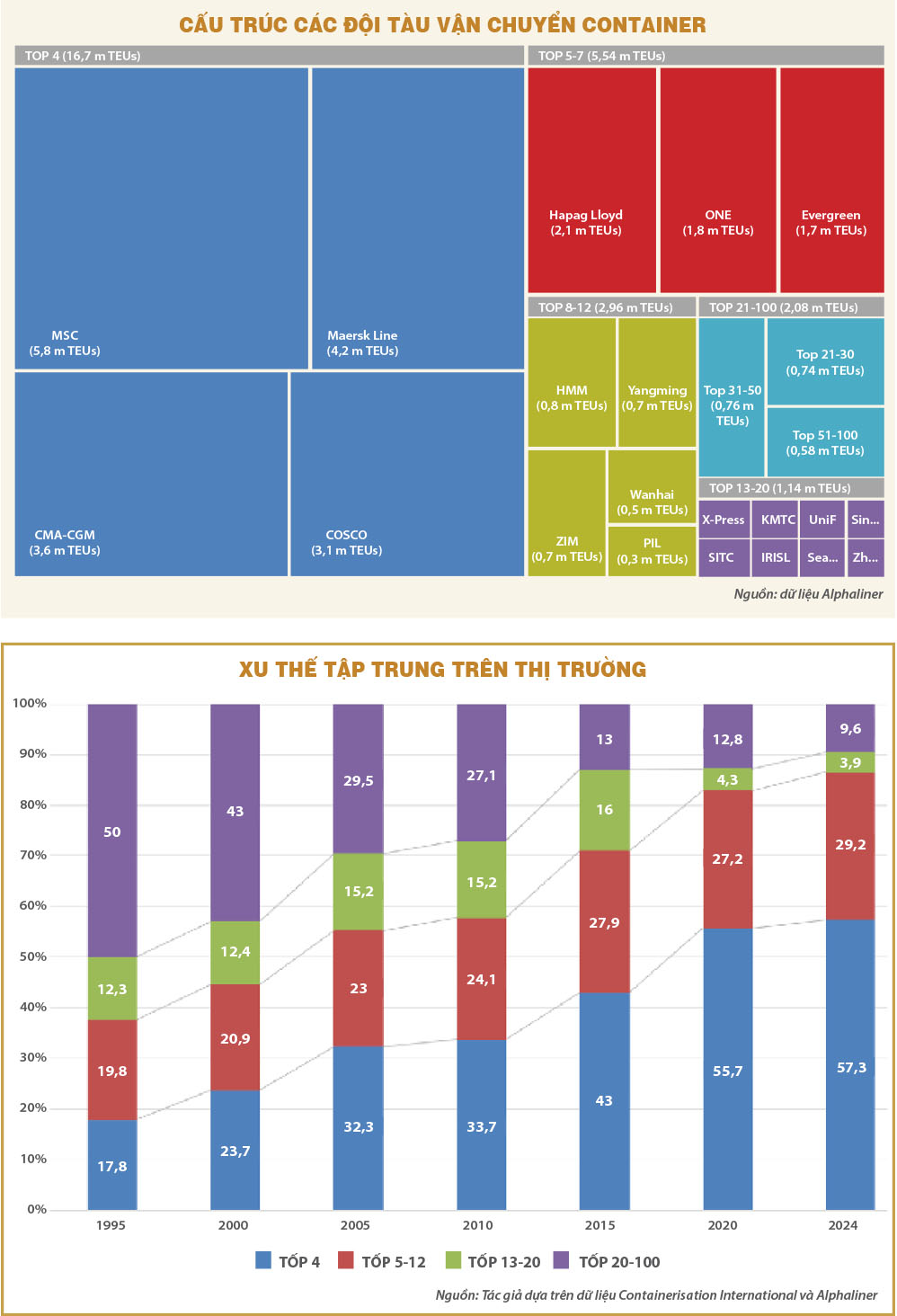

According to Alphaliner statistics in March 2024, the world’s container fleet consists of 6,868 ships with a total capacity of 29.1 million TEUs. The top 100 shipping lines account for about 98.2% of the transport market share, with the top 12 shipping lines alone accounting for 87%.

Notably, among them, 52 shipping lines have a market share of less than 0.08% with a fleet of less than 22,000 TEU, lower than the capacity of the largest container ship today (24,300 TEU). The group of 12 largest shipping lines (top 12) almost controls all ships over 10,000 TEU. In 2022, out of 665 ships in this super-large group, only 6 (under 15,000 TEU) will not be operated by the top 12.

There is also great polarization in this group of 12 shipping lines with a market share of over 10% belonging to the 4 largest lines: MSC (Switzerland) – 19.8%, Maersk Line (Denmark) – 14.5%, CMA-CGM (France) – 12.5% and COSCO (China) – 10.6%. The next group includes shipping lines from Germany, Japan, South Korea, Israel, Singapore.

The three East-West corridors (Atlantic, Pacific and Asia-Europe) connecting Asia, Europe and North America play a pivotal role with 38% of global volume (60.9 million TEU in 2022). In addition, the world’s maritime industry also has North-South or South-South corridors connecting Latin America (15.1 million TEU) and Africa (15.5 million TEU).

Over 93% of the market share in the above axes is in the top 12. This group also controls nearly 65% of the intra-Asian market, the busiest regional route (40 million TEU) connecting import-export centers in Northeast Asia (China, Japan, Korea, Taiwan), Southeast Asia (Vietnam, Thailand, Singapore), South Asia (India, Pakistan, Bangladesh) and the Middle East.

Concentration Trend

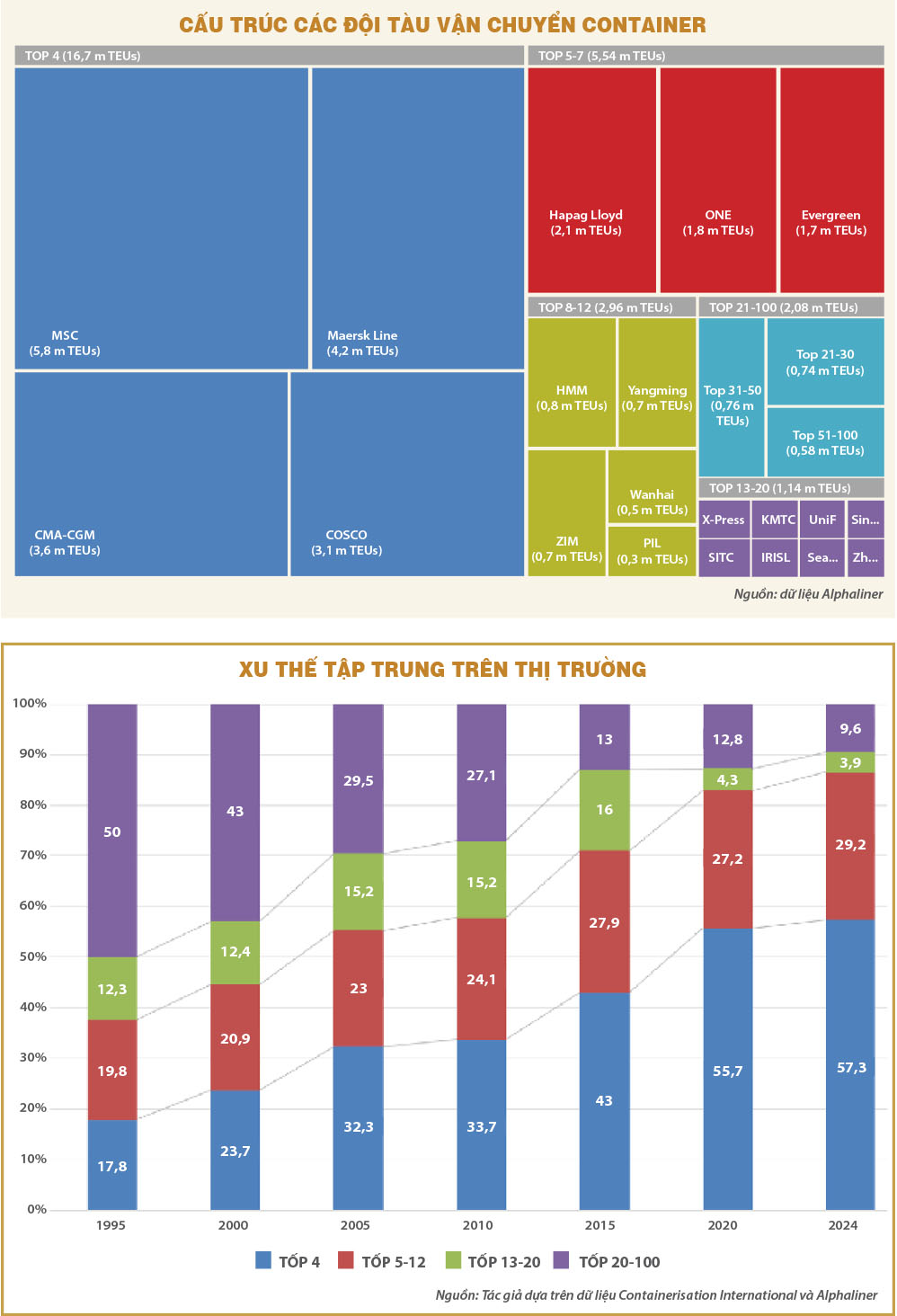

The market is increasingly dominated by a small number of mega-operators. The market share of the top 4 increased from 17.8% in 1995 to 33.7% in 2010 and 57.3% in 2024. Similarly, the market share of the top 5-12 also increased from 19.8% to 24.1% and 29.2%. Contrary to this trend, the decline of other groups, especially those outside the top 20, from 50% to 15.2% and 9.6%.

The gap in market share between the top and bottom lines has widened. In 1995, Sealand (the largest) had a market share of 5%, while UASC (21st) had nearly 1.1%. MSC now has a market share of nearly 20%, compared to TS Lines (21st) with only 0.3%.

Until the middle of the last decade, most of the top 20 carriers operated long-haul transcontinental routes. Today, this activity is mainly limited to the top 12. This can be tentatively called a global carrier group, with representatives from 10 countries, Asia and Europe, and no representatives from the Americas or Africa as before.

Mergers and acquisitions (M&A) have significantly narrowed the global group. In the top 7, except for MSC and Evergreen with organic growth strategies, other competitors use M&A to expand rapidly. Maersk Line invested 8.1 billion USD to acquire major competitors Safmarine and Sealand (1999), P&O Nedlloyd (2005) and Hamburg Süd (2017). From a market share of less than 5%, COSCO jumped after acquiring CSCL (2015) and OOCL (2018). CMA-CGM put an end to the APL brand after acquiring NOL (2016). Hapag Lloyd also successfully acquired CP Ships (2005), CSAV (2014) and UASC (2016). In 2023, rumors appeared in the market that Hapag Lloyd wanted to acquire HMM. ONE is the only new brand in the top 12 since 1995, but it is a combination of three long-standing Japanese names in 2018: NYK, MOL and K-Line.

Before 2014, some countries such as China, Singapore, Germany, South Korea and Japan owned two to three global shipping lines. Today, they have only one shipping line due to the impact of the above M&A activities or the bankruptcy of Hanjin in 2017. Taiwan is an exception with three shipping lines in the top 12: Evergreen, Yang Ming and Wan Hai. However, it is not excluded that Taiwanese shipping lines will merge to create a new force as happened with China-Hong Kong and Japan shipping lines.

Narrow window for other groups

The dominance of the top 12 limits the market for other players in the short regional, domestic, or feeder routes. Some new carriers have entered the top 20 but have a narrow coverage. Unifeeder (Denmark) operates short routes in Europe. Sinokor, KMTC (South Korea) and SITC (Hong Kong) operate intra-Asia routes. IRISL focuses on the Caspian Sea and Persian Gulf. Zhonggu is China’s largest domestic operator, with its first international route launching in 2021 connecting to Vietnam.

The market is increasingly dominated by a handful of mega-operators. The market share of the top 4 increased from 17.8% in 1995 to 33.7% in 2010 and 57.3% in 2024.

As a major manufacturing hub, Southeast Asia has favorable conditions for developing maritime transport activities. However, there are currently only 14 operating shipping lines: Singapore (6 lines – capacity 707,000 TEU), Indonesia (4 lines – 137,800 TEU) and Thailand (1 line – 137,800 TEU), Malaysia (1 line – 12,800 TEU), Vietnam (1 line – 9,100 TEU) and the Philippines (1 line – 8,700 TEU). The harshness of the market is evident in the disappearance of two brands after struggling with financial difficulties in the past decade: NOL/APL (Singapore), which was ranked 5th in the world, and MISC (Malaysia), a member of the Grand Alliance since 1998.

Three Singaporean shipping lines are in the top 20, including PIL (12th), X-PRESS Feeders (13th) and SeaLead (18th). PIL is the only member of the top 12 that does not operate any transcontinental routes on the East-West axis, but mainly on routes connecting Africa, Latin America and intra-Asia. X-PRESS Feeders is the world’s largest feeder operator with a unique model of not owning containers and serving the feeder needs of other shipping lines. Operating since 2017, SeaLead has experienced very rapid development. Similar to CULines (China), SeaLead took advantage of the very high demand for transportation in the period of 2021-2022 to develop Asia-Europe or trans-Pacific routes, but these routes were soon discontinued. RCL (Thailand) is a veteran shipping line since 1979 and has been stable in the top 30, but its scope of operation is only in Asia.

The trend of oligopoly in the shipping market has a great impact on the seaport and fleet strategy in countries dependent on maritime transport such as Vietnam. It requires narrowing port operations to a very small number of companies with strong potential, the spread will lose the advantage of the seaport’s cargo source compared to powerful shipping lines. Developing a container fleet to distant markets in Europe or America is completely unfeasible due to barriers in capital, exploitation and service networks, and market access. Real opportunities are only available to bulk carriers with operational flexibility, along with domestic container routes or near feeder routes.

Source: KinhteSaiGononline