International transport and logistics market Week 35/2024

International Container Shipping and Logistics Market Update for Asia, Europe and North America in Week 35/2024.

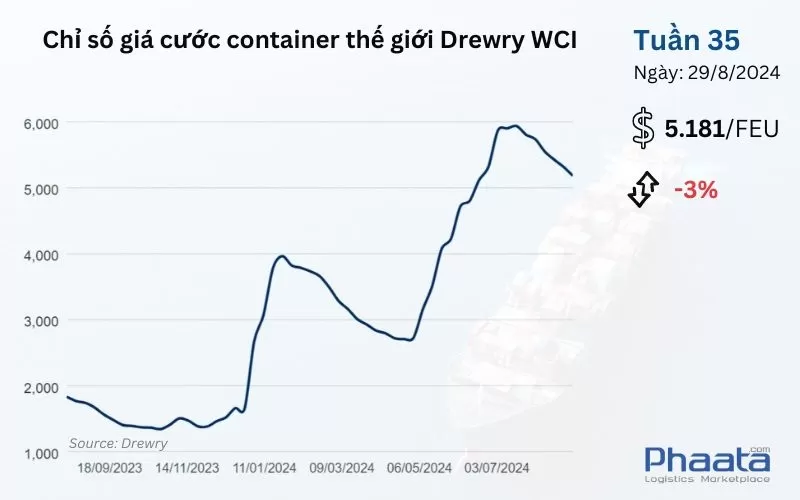

Drewry’s composite global container freight rate index for Week 35/2024 continued to decline by 3% compared to the previous week, to USD 5,181. This freight rate index is 265% higher than the pre-pandemic average of 2019 (USD 1,420).

1. Asia – North America

Ocean Freight rates from Asia to the West Coast of North America in week 35/2024 fell to $6,670/FEU, down 1.81% week-on-week and 4.7% month-on-month, according to Xeneta data.

Export demand remains strong, and many carriers have added capacity to ease backlogs caused by the surge in cargo volumes from May to July. However, current inventory levels may reduce the need for additional cargo in the coming weeks,

There are multiple cancellations on routes to the Cape of Good Hope (COGH) and port congestion in Asia and North America. Further delays and capacity challenges are expected on the US East Coast due to adverse weather conditions around COGH.

Water levels in Panama’s Gatun Lake have recovered and local authorities have eased Panama Canal weight restrictions.

Carriers are implementing cancellations that will impact Weeks 38 to 41 to adjust capacity on the route in preparation for the upcoming Golden Week holiday in China. Changes to shipping schedules or transit times are expected, particularly for feeder connections, as cancellations may result in shipments being transferred to subsequent sailings.

Spot Rates: The General Rate Increase (GRI) on September 1 has been announced by carriers and is likely to be implemented by carriers, leading to higher rates.

Fixed Rates: Discussions on Peak Season Surcharge (PSS) remain unchanged. The upcoming September 1 GRI implementation has widened the gap between spot rates and long-term contract rates. The PSS is expected to remain in place until September 1.

Canada:

On August 24, 2024, the Canadian Labour Relations Board (CIRB) authorized binding arbitration between Canadian National Railway Company (CN) and Canadian Pacific Kansas City Limited (CPKC) and the Teamsters Canadian Railway Conference (TCRC). Additionally, the CIRB prohibited any further strikes, including lockouts or work stoppages, during the conciliation process. As a result, the recent stoppage notice issued by the Teamsters to CN is now null and void.

Both CN and CPKC workers returned to work Monday morning in Canada, per CIRB directives. The CPKC has asked TCRC workers to return to work on Sunday shifts to quickly restart the Canadian economy and minimize further disruptions to the supply chain.

While they will comply with the CIRB’s decision, the Teamsters will also appeal the ruling in federal court.

2. Shipping lane: Asia – Europe

Freight rates from Asia to North Europe continued to fall sharply in week 35/2024 to USD 7,550/FEU, down 4.02% week-on-week and 11.20% month-on-month, according to Xeneta data.

Weak demand, coupled with many canceled sailings, reduced activity in late August. Shipping vessels were used relatively efficiently with a fairly high liner occupancy rate. However, in September, with many vessels returning to Asia, the market will have more capacity than in August. Shipping lines are now pushing to fill vessels by increasing cargo volumes.

Spot rates fell further in the first half of September, but remained higher than in early 2024, after the Lunar New Year. Carriers are now taking a more proactive approach to adjusting rates to optimize vessel utilization.

The use of long-term contract rates still faces constraints from carriers in terms of space and equipment priorities. Equipment shortages are improving, with some ports of loading (POLs) with fewer vessels calling still experiencing potential shortages of container types, particularly 20’GP and 45’HC.

3. Shipping lane: North America – Asia

Freight rates from North America (West Coast) to Asia in week 35/2024 increased to USD 666/FEU, equivalent to a 1.06% increase compared to the previous week, down 3.62% compared to the previous month, according to Xeneta data.

Capacity has been reduced on routes from the US to the Indian subcontinent, Middle Eastern ports and Northern European ports, related to vessel shortages and canceled sailings.

To ensure smooth export of goods, Phaata.com advises shippers to book 2 weeks in advance for shipments loaded at coastal ports and 3-4 weeks or more for shipments loaded at inland rail points.

4. Shipping route: Northern Europe – Asia

Freight rates from Northern Europe to Asia in week 35/2024 decreased slightly, at USD 492/FEU, equivalent to a decrease of 0.2% compared to the previous week, up 1.65% compared to the previous month, according to Xeneta data.

Source: Phaata.com